🚀 Exclusive Private equity opportunity 🚀 A Wall St. Veteran's #1 Investment Recommendation

🚀 Exclusive Private equity opportunity 🚀

Invest In The Future of Private Markets and Alternative Investments

Secure Your Stock In Capital Engine®, an Innovative Platform Transforming $2.5 Trillion Private Capital Markets And Secondaries Trading Infrastructure.

Invest In The Future of Private Capital Markets and Alternative Investments

Secure Your Stock In Capital Engine®, an Innovative Platform Transforming

$2.5 Trillion Private Capital Markets And Secondaries Trading Infrastructure.

20x - 70x Returns. Described as an "Early Uber Like Opportunity" By Wall

Street Veteran and Fortune's Top 50 Great Investor - Michael Markowski

Described as an "Early Uber Like Opportunity"

By Wall Street Veteran and Fortune's Top 50 Great Investor - Michael Markowski

👇 Key Investment Highlights 👇

A unique opportunity to invest early in a high-growth, revenue generating platform with proven traction & significant growth potential.

Deal Type - Series Seed Preferred

Potential Returns - 20-70x

Min. Invest - $24,000 (10,000 shares at $2.40 / share)

Discount - Up to 40%* on share price

Valuation - $2 million (post-money valuation $17 million)

Shares projected to be liquid by 2026

Acquisition of broker-dealer, positions Capital Engine® as a leader in the tech enabled private placement space

Proven Traction & Strong Financials - Capital Engine's Private Market Platform and software solutions have helped raise $450 million

Significant Growth potential - Actively raising $250 million through Private Market Platform, and a deal pipeline of $650 million+ potential raises

Developing a groundbreaking secondary trading platform for private securities

Get more details about the offering

Get more details about the offering

👇 Key Investment Highlights 👇

A unique opportunity to invest early a high-growth, revenue generating platform with proven traction & significant growth potential.

Deal Type - Series Seed Preferred

Potential Returns - 20-70x

Min. Investment - $24,000

(10,000 shares at $2.40 / share)

Discount - Up to 40%* on Share Price

Shares projected to be liquid by 2026

Acquisition of broker-dealer, positions Capital Engine® as a leader in the tech enabled private placement space

Proven Traction & Strong Financials - Capital Engine's Investment Marketplace and software solutions have helped raise $450 million

Significant Growth potential - Actively raising $250 million through Investment Marketplace, and a deal pipeline of $650 million+ potential raises

Developing a groundbreaking secondary trading platform for private securities

Offering Details

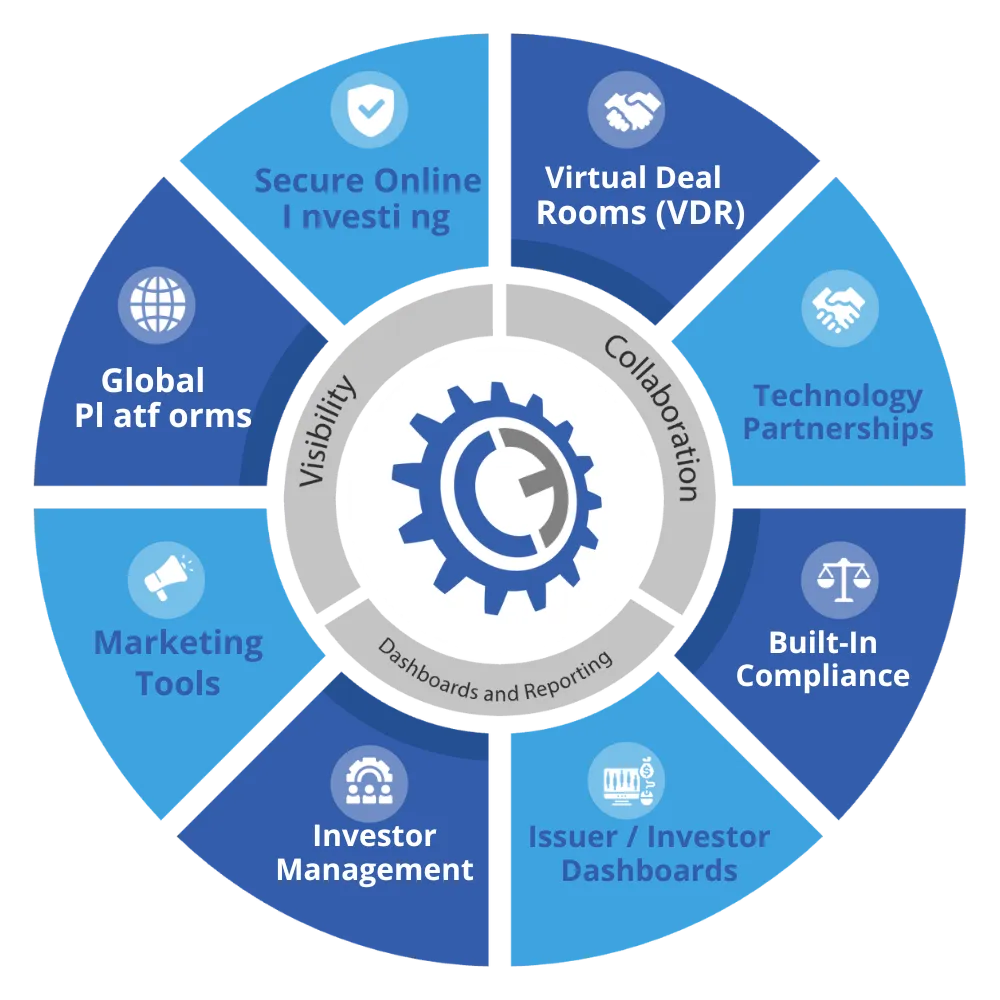

Capital Engine® is transforming the $2.5 trillion exempt private capital markets infrastructure (CMI) and subsequent secondaries trading landscape, creating an organized market for private capital, digital assets, and other exempt securities.

Capital Engine® is a private markets technology company, that builds customized private capital, secondary market infrastructure and investor management solutions for investment banks, broker-dealers, family offices, investment platforms, law firms, and real estate funds.

Our technology delivers cost cutting and time saving solutions for the benefit of:

Private companies seeking to grow at a more reasonable cost of capital

Investment groups seeking new revenue streams and cost cutting compliance solutions

Institutional / private equity / fund managers needing tools to manage large investor communities

👇 Watch The Elevator Pitch 👇

Broker Dealer Services

Capital Engine® continues strategic growth with Mallory Capital Group strategic partnership, a full-service, independent broker-dealer and member of FINRA and SIPC.

Mallory is a well-established private placement agent that raises institutional and private capital for investment managers across a wide range of alternative strategies.

With over $10 billion raised and a combined 80 years of capital raising and advisory experience, Mallory is a leading private securities placement agent.

👇 Watch The Elevator Pitch 👇

We are offering the following discount packages, valid till end of Nov 24:

Minimum Investment: $24,000 - 20% share price discount i.e. 10,000 shares at $2.40 / share

Average Investment: $100,800 - 30% share price discount i.e. 48,000 shares at $2.10 / share

Major Investment: $250,200 - 40% share price discount i.e. 139,000 shares at $1.80 / share

Capital Engine® Perpetual Financing Strategy

| Share Price | $3/ share* | $6 / share | $12 / share |

|---|---|---|---|

| Pre-Valuation | $15,000,000 | $30,000,000 | $60,000,000 |

| Post-Valuation | $17,000,000 | $33,000,000 | $65,000,000 |

| Amount Raised | $2,000,000 | $3,000,000 | $5,000,000 |

| Shares to be sold | 754,167 | 500,000 | 416,667 |

| Ownership Dilution | 12.6% | 10% | 8% |

Why Private Markets Need Capital Engine®

The Problem

Private Securities Markets Lack the Infrastructure of Public Markets*

Investor Access

Private securities and alternative investments are not readily available to the general public. Thus, the average individual retail investor is denied access to potentially attractive investments in some of the world’s fastest growing enterprises

Limited Liquidity

Liquidity is limited for private companies and alternative assets. Where liquidity does exist, the experience is inefficient.

Fragmented Market Infrastructure

Unlike public markets with established platforms like NYSE or NASDAQ, private markets lack a unified, efficient infrastructure for trading and managing securities.

Capital Engine® Solution

Our tiered private markets ecosystem addresses these key pain points

- Capital Engine operates an online capital raising marketplace and tech enabled private placement platform for small and large raises

- Private Market Platform and software solutions have helped raise $450M of capital

- Alternative Trading System (ATS) provides off-ramp to investors looking for transparency and liquidity

- Capital Engine® ATS will support investing and trading in alternative, fractionalized & digital assets

- Capital Engine is a SaaS B2B company providing a private (white) label business solution

- Extremely scalable with synergistic benefits to our other operations and long-term recurring revenue

- Strategic Partnership with revenue sharing options

Capital Engine® is transforming the $2.5 trillion exempt private capital markets infrastructure (CMI) and subsequent secondaries trading landscape, creating an organized market for private capital, digital assets, and other exempt securities.

Capital Engine® is a private markets technology company, that builds customized private capital, secondary market infrastructure and investor management solutions for investment banks, broker-dealers, family offices, investment platforms, law firms, and real estate funds.

Our technology delivers cost cutting and time saving solutions for the benefit of:

Private companies seeking to grow at a more reasonable cost of capital

Investment groups seeking new revenue streams and cost cutting compliance solutions

Institutional / private equity / fund managers needing tools to manage large investor communities

Broker Dealer Services

Capital Engine® continues strategic growth with Mallory Capital Group strategic partnership, a full-service, independent broker-dealer and member of FINRA and SIPC.

Mallory is a well-established private placement agent that raises institutional and private capital for investment managers across a wide range of alternative strategies.

With over $10 billion raised and a combined 80 years of capital raising and advisory experience, Mallory is a leading private securities placement agent.

Growth Capital

Capital Engine® Series Seed

Preferred Investment Round

Offering Highlights:

$2 million (post-money valuation $17 million)

20% discount on $3 share price*

Min. Invest: $24,000 (10,000 shares at $2.40 / share)

Capital Engine’s Investment Marketplace and software solutions have helped raise $450 million

Actively raising $250 million for clients

Deal pipeline: $650 million+ potential raises

Funding will accelerate and scale revenue growth focusing on strategic partnerships, expanding broker-dealer, sales and marketing, onboarding key staff, and setup of secondary trading platform

Shares projected to be liquid by 2026, 20x - 70x return

*Discount valid for MicroCap Rodeo Spring into Summer Conference

Capital Engine® Perpetual

Financing Strategy

| Share Price | $3/ share* | $6 / share | $12 / share |

|---|---|---|---|

| Pre-Valuation | $15,000,000 | $30,000,000 | $60,000,000 |

| Post-Valuation | $17,000,000 | $33,000,000 | $65,000,000 |

| Amount Raised | $2,000,000 | $3,000,000 | $5,000,000 |

| Shares to be sold | 754,167 | 500,000 | 416,667 |

| Ownership Dilution | 12.6% | 10% | 8% |

* 20% Discount valid for MicroCap Rodeo Spring into Summer Conference

Capital Engine® is a financial technology company, that provides scalable private capital market infrastructure and investment management solutions, for broker-dealers, investment banks, family offices, wealth managers, and real estate funds. © 2024 Capital Engine® private and confidential

Market Opportunity

Capital Engine® is strategically positioned to capitalize on the explosive growth in private capital markets:

Private Capital Markets Are Transforming

$1.23 T

Public Markets

$4.45 T

Private Markets

$2.3 T

Private Placements

2022

* Private capital markets are rapidly transforming and have surpassed public markets to become the more popular way for companies to raise capital in the US. According to the most recent SEC data, for the 12 month period ending June 30, 2022, exempt offerings accounted for approx. $4.45 trillion in capital raising, whereas during that same time period, publicly raised funds accounted for roughly $1.23 trillion in fundraising. That’s 3.5 times more capital raised in the private markets than in the public markets.

Secondaries Market For Private Capital is Growing

10

Years

6X

Growth

$130 B

Secondary Markets

2023

Private Capital Markets Are Transforming

$1.23 T

Public markets

$4.45 T

Private markets

$2.3 T

Private Placements

2022

* Private capital markets are rapidly transforming and have surpassed public markets to become the more popular way for companies to raise capital in the US. According to the most recent SEC data, for the 12 month period ending June 30, 2022, exempt offerings accounted for approx. $4.45 trillion in capital raising, whereas during that same time period, publicly raised funds accounted for roughly $1.23 trillion in fundraising. That’s 3.5 times more capital raised in the private markets than in the public markets.

Secondaries Market For Private Capital is Growing

10

Years

6X

Growth

$130 B

Secondary Markets

2023

* The secondaries market, where buyers and sellers trade existing interests in private equity funds and their portfolio companies, has grown to $130 billion, a six-fold increase during the past decade (this vs. US public equity markets, which turn over $200 billion in assets daily). Given the rapidly expanding need for liquidity solutions in private capital, the potential for continued growth is exponential.

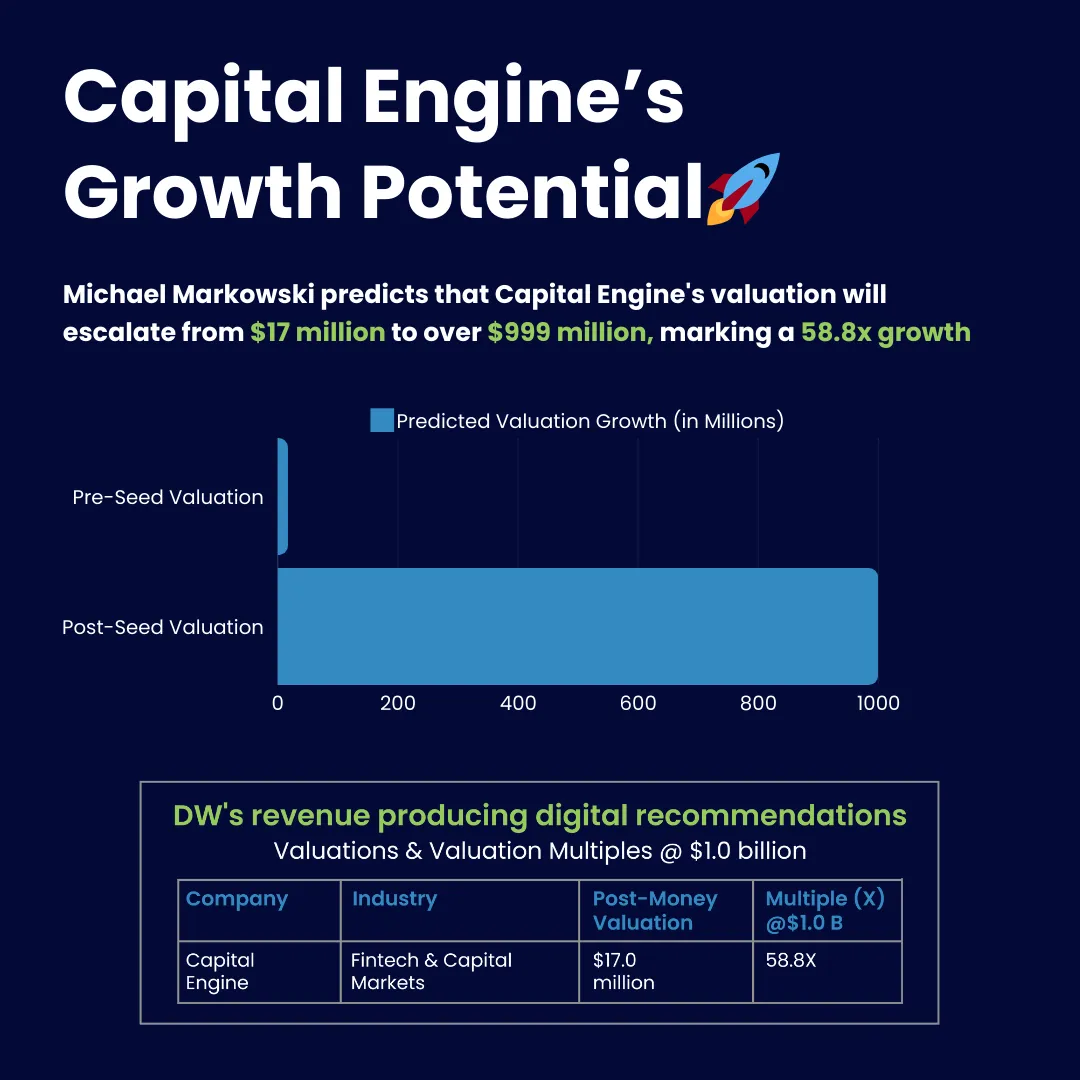

wall street veteran - Michael Markowski's Take On Capital Engine®

"Capital Engine® is My Top Investment Recommendation. They have the potential to become 10 times bigger than similar platforms"

Michael Markowski (Fortune's Top 50 Great Investor, Wall Street Legend.

Well-known for predicting several market events including the 2008 crash)

Michael Markowski (Fortune's Top 50 Great Investor, Wall Street Legend. Well-known for predicting several market events including the 2008 crash)

"Capital Engine® is My Top Investment Recommendation"

"Capital Engine® has the potential to become 10 times bigger than it's competitors"

"Capital Engine® is one of the best risk-reward opportunity"

Trusted By Organizations Globally

Capital Engine® helps Texas-based CRE Income Fund to collaborate, operate, and fundraise more efficiently, all while delivering an unparalleled experience to their existing and prospective investors.

Robert Waitte

CRE Income Fund, Director

Capital Engine® worked with our team to ensure our complete marketing campaign was available in one place for the investor to have access to all the required information. We are extremely pleased with the outcome and successful capital raise of over $8M.

Mario Romano

Investview Inc., Director of Finance & PR

Alto and Capital Engine® share a mission of providing new ways for startups and entrepreneurs to raise capital and enabling everyday people to take part in investment opportunities, once only available to the wealthy and well-connected.

Tara Fung

Alto, Chief Revenue Officer

Strategic Partnerships and Key Business Technologies

Strategic Partnerships and Key Business Technologies

Meet our Team

Capital Engine® has built an exceptional team (ex Wall St veterans) with a proven track record for success including a strong advisory board with broad experience, expertise and resources in global financial services, commercial real estate, alternative investments, fintech, blockchain, marketing and securities.

Conrad Weymann

Chairman | Mallory Capital Group

Bryan Smith

Chief Executive Officer (CEO)

Will Green

Chief Operating Officer (COO)

Irwin Stein

General Counsel

Mike Ireland

Director Mallory Capital Group

Christopher Thompson

Business Advisor

Marty Jensen

Business Advisor

Andrew Schrieber

Capital Engine® UK

Duncan MacRobert

Strategic Advisor

Anthony Stonefield

Business Advisor

Frequently Asked Questions

What is Capital Engine®?

Capital Engine® is a comprehensive platform providing private capital market infrastructure, enabling businesses to raise capital and trade private securities efficiently. It supports broker-dealers, family offices, investment platforms, and real estate funds.

How does Capital Engine® transform private capital markets?

Capital Engine® simplifies private market transactions by providing an all-in-one platform for private companies and investors. It facilitates secondary market trading, making private company shares more liquid and accessible.

What is the secondary market, and how does Capital Engine® facilitate it?

The secondary market allows trading of private company shares after the initial offering. Capital Engine® provides the infrastructure for these transactions, enhancing liquidity in traditionally illiquid markets.

How does Capital Engine® generate revenue?

Capital Engine® generates revenue through its technology platform, offering capital raising solutions, investor management services, and secondary market trading tools for private securities and digital assets.

How can I learn more about investing in Capital Engine®?

To learn more about investing in Capital Engine®, simply fill out the form above. Once completed, you'll receive access to detailed investment materials and the opportunity to connect with our team for further information.

What is the Capital Engine® Private Market Platform?

The Capital Engine® Private Market Platform connects investors with exclusive private market opportunities, including private equity, real estate funds, and alternative investments. The platform streamlines the investment process by offering direct access to vetted deals and a secure, transparent investment experience.

What is Capital Engine®'s track record?

Capital Engine® has successfully raised over $450M for clients, with a pipeline of $650M+ in active deals. Our proven platform has helped businesses across various sectors access capital and enabled investors to diversify their portfolios with private securities.

What is the minimum investment in Capital Engine®?

The minimum investment is $24,000, which provides 10,000 shares at a discounted price of $2.40 per share for the first 30 confirmed investors.

What are the projected returns for Capital Engine® investors?

Capital Engine® targets a valuation of $300M by 2026, offering investors the potential for a 20x - 70x return on their investment.

Important Message: In making an investment decision, investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved. Investments on Capital Engine® are speculative, illiquid, and involve a high degree of risk, including the possible loss of your entire investment.

Capital Engine® is a financial technology company, that provides scalable private capital market infrastructure and investment management solutions, for broker-dealers, investment banks, family offices, wealth managers, real estate funds and equity crowdfunding portals.

Capital Engine® is not licensed by or registered with the U.S. Securities and Exchange Commission, FINRA, or any other financial services regulator. Specifically, Capital Engine® is not a FINRA registered Broker Dealer and does not offer or sell securities, or engage in any other Broker Dealer activity. Nothing in this website constitutes an offer, distribution, solicitation, or marketing of any security. Capital Engine® is not an exchange, alternative trading system, escrow agent or transfer agent. Capital Engine® does not provide legal, accounting, tax, or regulatory advice, or hold custody of cash, virtual currency, security token or digital assets for or on behalf of any third party.

Certain securities related activities are conducted through Mallory Capital Group, LLC, a registered broker-dealer and member FINRA/SIPC. By viewing and using CapitalEngine.io you agree to be bound by our Terms of Use and Privacy Policy.

No communication, through this website or otherwise, should be construed as a recommendation for any securities offering on or off our platform. Securities are offered pursuant to Regulation Crowdfunding of the Securities Act of 1933 ("Reg Crowdfunding Offerings"), Regulation D of the Securities Act of 1933 ("Reg D Offerings") and Regulation A of the Securities Act of 1933 ("Reg A+ Offerings"). All company listings are only appropriate for investors who are familiar with and willing to accept the high risk associated with startup investments. Securities sold are not publicly traded and are not liquid investments. Companies seeking investments through equity crowdfunding tend to be in very early stages of development with little or no operating history. Investors must be able to afford to hold their investment for an indefinite period of time, as well as the ability to lose their entire investment.

© 2018 - 2024 Capital Engine® Inc. All Rights Reserved.

Facebook

Instagram

X

LinkedIn